Data Intellect sends Gary to Space

Read time:

3 minutes

Gary Davies

Why

Ok, so the title is a little misleading, they sent me to the UK Space Conference 2023 which was being held in Belfast – it didn’t take any persuading, in my head I’m still an aerospace engineer visiting the finance space.

This blog is going to be an overview of my day looking at some interesting snippets, the importance of data from the conference and of course drawing parallels on the challenges Data Intellect and our clients face in the world of finance – the relevance of which is key – we are experts in real-time data and real-time data problems.

Space for our Future

From an EO perspective, it was about capturing data and then utilizing that to add value, be it crop rotation, flight routes, maritime traffic or container tracking - all of which can be done but perhaps is not being leveraged or accessed by parties that can benefit.

The sustainability side of things looked at the now 54 essential climate variables of which many are calculable from space - this was something I wasn't aware of and resulted in some quick googling to see what those are, I suggest you take a look.

My interest from all this was immediately piqued, the above boils down to the data that satellites capture and that is then relayed as close to real-time as possible (Space isn't exactly servers co-located in an exchange, so there is a fair amount of latency) and then that data is available to see the change over time.

Its worth pointing out from this talk that there is an EO Data Hub which can be used to serve public and commercial uses.

Can space science be agile? Challenging the status quo

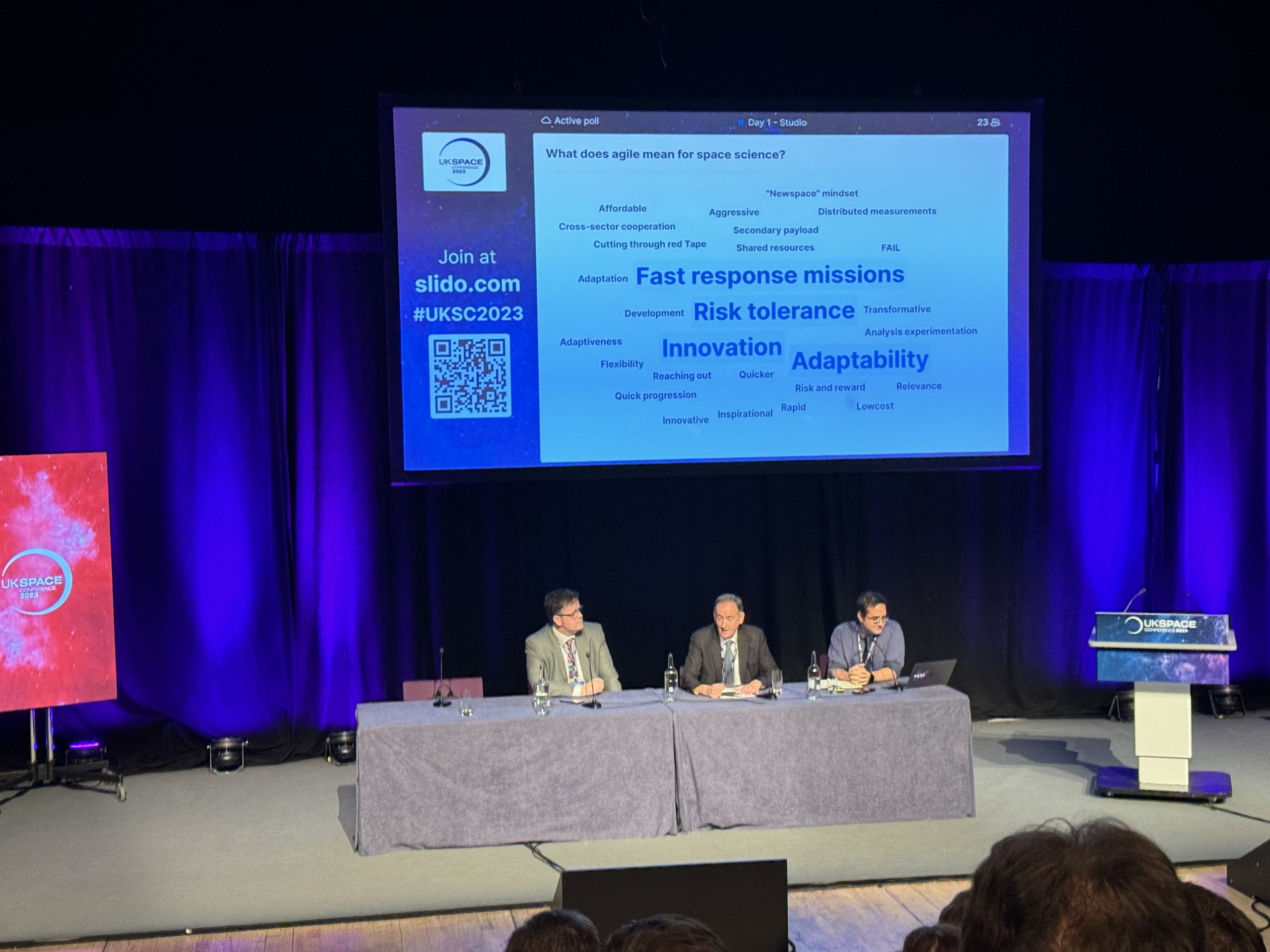

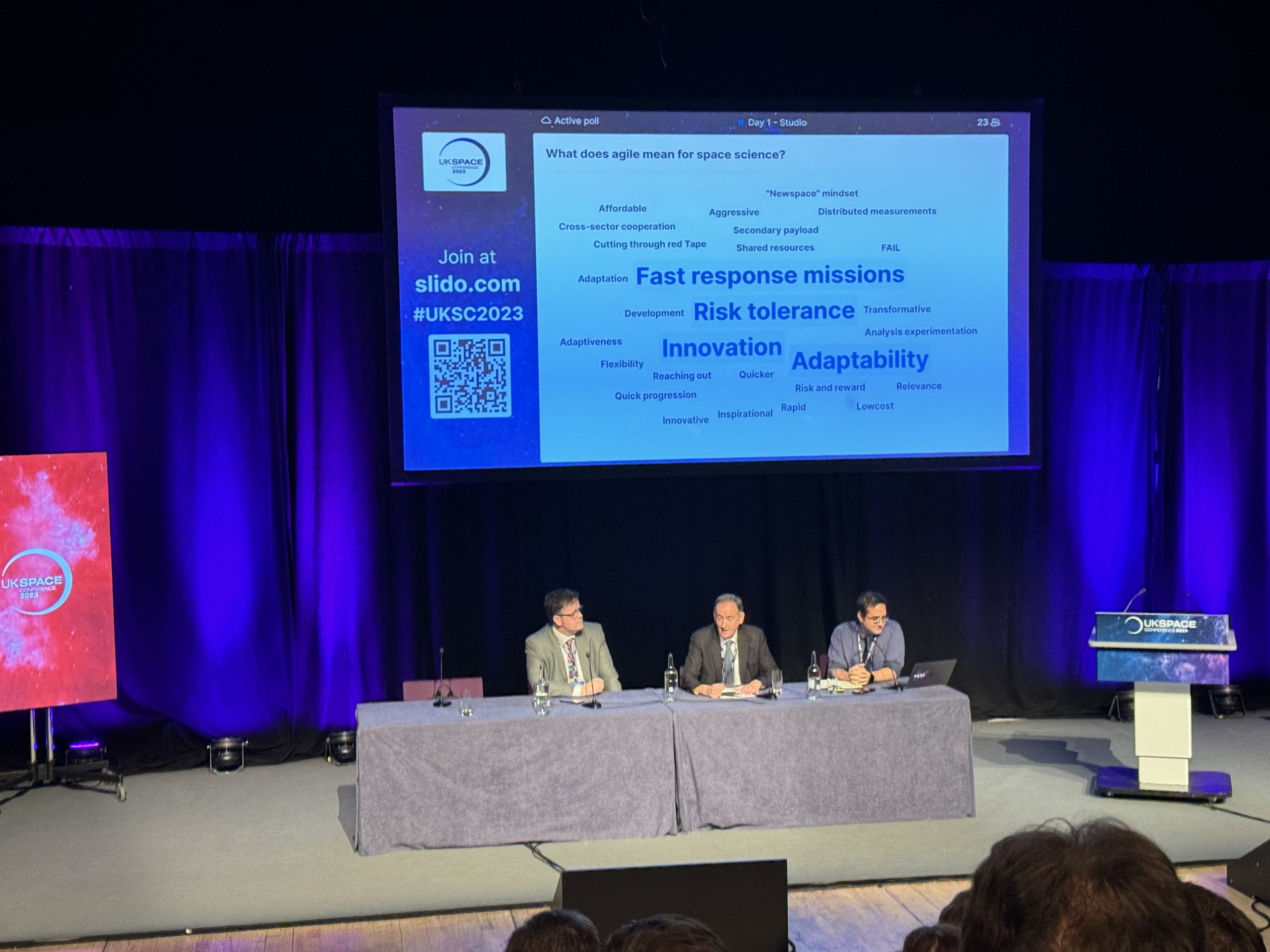

This was another panel event that saw 2 university professors and Michael Healy from the European Space Agency discuss whether space science is evolving too slowly. I found I could draw parallels here to what's often seen in the finance space; the challenges of regulation, funding, the structure of large companies and continual developments in technology meaning that companies can struggle to be agile enough to switch gears or direction.

With crowd involvement, we were challenged to flag key words pertaining to what agile means for space science, which I've included in the photograph. I think may of these will resonate with my colleagues in the capital markets space - showing that there is a correlation between the two complex environments.

I did like the idea of a secondary payload here - the concept of having dual usage from the same deliverable, though I'm not sure how easy that translates across.

One of the key statements, for me, in this discussion was "show that data makes a difference".

Where will technology take EO next?

Justin Byrne, head of EO at Airbus raised about all the data that the next technological advances will allow us to capture and we can head toward a pseudo real-time consumption which could then be fed to AI. Florian Deconinck of Open Cosmos differentiated upstream and downstream in the space world, before declaring he would like to see downstream tech that could allow end users interact with requests that could then be fulfilled by the upstream and have a system managing this.

From an audience question there was discussion around the issues of accessing data in the space domain - which it turns out is not dissimilar to how a lot of end users feel in capital markets - the data is there, but end users don't know where to get it from or which datasets they may need to get/join/analyse to get what they want. This is especially true for non-space companies trying to access the data. I believe it was Florian who stated its about getting information from the data easily.

The topic of AI is never far away, and here it was described as a game changer given the petabytes of data that is available and the possibilities we can't even be sure of yet. A quote of approximately 30% of data not being used in a value-add fashion also shows that dead data is something we all face, no matter the domain.

Insights beyond imagery: How the cutting edge of EO techniques generates more information

In the first presentation Dr Carmine Clemente from the University of Strathclyde demonstrated how Synthetic Aperture Radar (SAR) can be used with vibrational analysis to identify sizes of maritime vessels, issues with bridges and nuclear experimentation, before Pat from MDA talked to the maritime use cases.

Charles Davis stepped up from Earth-i and presented how they have been using EO data to determine production rates of commodities to gain information which with algorithms and AI can feed into commodities trading - something which many hedge funds are interested in, and using. I was not expecting a talk to be so relevant to the finance domain at a space conference but this was honestly incredible. In the world where Earth-i (and the Savant Algo) doesn't exist it takes 30-90 days to get the information which can be inaccurate due to the nature of how its captured, yet now it can be gathered within 1 day with a 5% tolerance....incredible.

Charles also made some great points that I think are worth sharing:

1. Business strategy of Interesting, Valuable and Invaluable - if you want to pitch something it better be interesting or you won't get through the door, it must be valuable otherwise whats the point, and in the end it must be invaluable as you need to keep it in.

2. Gucci Data - when "purchasing" data you have to really consider the cost. The cost should never be more than the value that data will add. For any of our clients, don't be surprised if you hear this, its my new favourite term.

3. Use data that is just good enough for your use case, not better.

Technology Landscape: Trends and Opportunities

Hearing everyones viewpoints on their area and the interdependencies was fantastic, I think my key take away is that the Semiconductor technology is the one we need to watch as without it you can't have the others.

As with every AI discussion, the group talked to the ethics and regulations of this data but all agreed that this is game changing and its now about adoption of it.

The Parallels are there

The conference was not merely a welcome break from finance, rather for me a chance to draw parallels to what I see day to day in my role. It’s also about opportunities, of course, given the aforementioned expertise.

The data challenges in the space domain are the same we face in finance:

- Too much data

- Data value not being realized

- Dirty data

- Latency (albeit not nanos)

- Accessibility

- Infrastructure

- Interoperability

And the approach to AI echoes also: You need the data to be right/clean/accurate before sending in the AI, it needs correct regulations and scope BUT it needs to be investigated, adopted, adapted and used.

So what do I think?

SAME CHALLENGES, DIFFERENT SPACE

Share this: