New TorQ-FX Released

Jamie Grant

For anyone who has used TorQ, you will most likely be familiar with the Finance Starter Pack. The starter pack is an example data capture system that is based on randomly generated equity data. It was created with the purpose of showing how to set up an example TorQ installation and how different applications can be built and deployed on top of the TorQ framework. Today we are excited to release the TorQ-FX pack!

The TorQ-FX pack is another example of one type of system that can be created through the use of the TorQ framework. One of the main differences from the Finance Starter Pack is that the TorQ-FX pack will be using real data! The pack will build and maintain an FX database by using data taken from GAIN Capital. The data consists of bid and ask prices for a range of over 70 currencies dating back over 15 years, with new data being made available each week. This data can be automatically downloaded and stored in an on disk HDB, with the system continuing to download and add the new data each week.

The system uses a Downloader process to pull the FX market data from the GAIN Capital site. The Filealerter takes this data and will process and save it to an on disk HDB. The data is then loaded into the HDB processes. The Downloader process has various settings that can be customized, such as a date to download from on start-up of the system, so if you start from 2000.05.01 the system will download and build a database with roughly 17 years worth of FX data. Emailing can be set to inform you when new files are downloaded. The time the download function will automatically run each day, as well as the currency pairs it should download by default can also be set. For detailed information on the mechanics and architecture of the system please have a look at the TorQ-FX Documentation pages.

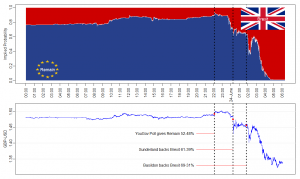

To demonstrate TorQ-FX in action we can have a look at how the FX market moved on the day leading up to the Brexit vote. The FX market data can be easily extracted from the GAIN Capital site using the TorQ-FX Downloader process. For comparison, the Implied Probability of a Brexit vote was taken from Betfair using the TorQonnect-Betfair framework. The betting markets had the probability of a Brexit vote as low as 6.3{e673f69332cd905c29729b47ae3366d39dce868d0ab3fb1859a79a424737f2bd} before the pound plummeted against the dollar as the results rolled in, hitting a 31 year low of $1.324. The correlation between the betting and FX markets is remarkable!

TorQ and the TorQ-FX pack can be downloaded from the AquaQ Github so go ahead and take a look!

If you want to know more or are having data capture architecture issues, please get in touch.

Share this: