Read time:

5 minutes

Samantha Devlin

Surveillance Gets Smarter

In early July 2025, India’s market regulator (SEBI) slapped an interim ban on Jane Street, accusing the firm of pump-and-dump manipulation of the Bank Nifty index in the National Stock Exchange (NSE). SEBI’s investigators found the smoking gun by combing through mountains of trading data, slicing and dicing minute-by-minute stock, futures, and options records to spot a recurring pattern. An interesting aspect of this case is what it means for the future of market surveillance and market abuse controls.

[Image: finshots.in]

A Data-Driven Discovery of an ‘Expiry Day’ Pattern

From January 2023 through May 2025, SEBI’s data scientists pored over two-and-a-half years of trading logs, hunting for anomalies on index derivative expiry days. What emerged was a striking pattern on at least 15 Bank Nifty weekly expiries: Jane Street’s algorithms appeared to boost the index early in the day, then pushed it down by the close, aligning perfectly with the firm’s index options positions. By crunching cross-product data through equities, index futures, and options, SEBI uncovered that these moves were not random at all, but a coordinated strategy timed around the settlement of options.

How could such a scheme go unnoticed for so long? The answer lies in the sheer scale of modern markets. Jane Street’s trades were spread across dozens of stocks and instruments, making each day’s activity look like just another blip in India’s huge derivatives market. It took big data analytics spanning a large timeframe and forensic number-crunching to connect the dots. SEBI didn’t even need to examine every single day; it focused on about 20 high-profit days and found the pattern recurring on many of those. This targeted approach, akin to finding needles in a haystack of millions of trades, proved remarkably effective.

The Tactic in Action: Pump the Index, Fade the Options

At the heart of the scheme is a classic pump-and-dump tactic tuned for index derivatives. Here’s how it played out step by step:

- Morning Pump: Right after the opening bell, Jane Street’s traders (or rather, their algorithms) would buy large quantities of Bank Nifty’s 12 constituent bank stocks and related futures, driving the index upward. Orders were placed aggressively at or above the prevailing price essentially pushing the market up instead of passively waiting to be filled. This early buying spree artificially “pumped” the index level.

- Options Setup: As the index climbed, Jane Street loaded up on short index options positions that would pay off if the index fell later in the day. By late morning, the firm’s exposure was massively short on the index – in one example, their total Bank Nifty options delta went from the equivalent of a ₹7,300 crore short position to ₹39,400 crore short while they were pumping the index. This means they stood to gain if the index dropped from its pumped highs.

- Afternoon Dump: With those option bets in place, the strategy flipped. Jane Street swiftly sold off the bank stocks and futures it bought earlier (often starting around early afternoon or later). These heavy sell orders (often placed at or below the current price to speed up the decline) put downward pressure on the index, causing it to “dump” back down. By the end of the day when the options expired, the index often retreated to where it began or even lower, exactly as needed to make the short options positions profitable.

This one-two punch (pump up the index, then fade it) proved extremely lucrative on those specific days. For instance, on January 17, 2024 (one of the episodes highlighted by SEBI), Jane Street bought roughly ₹4,370 crore (~$550 million) of Bank Nifty stocks and futures in the morning and later sold ₹5,372 crore worth in the same session, netting about ₹735 crore profit in a single day. All told, SEBI tallied ₹4,843 crore (over $580 million) as illicit gains from 18 such days of trading (15 in Bank Nifty, 3 in Nifty) where this pattern played out. Those profits didn’t come from clairvoyance or luck; they came from moving the market and taking advantage of the ripple effects.

High-Frequency Forensics: How SEBI Caught On

It’s one thing to suspect manipulation; it’s another to prove it. SEBI’s surveillance teams used cross-product high-frequency forensic analysis to build their case. They synchronized data from cash equities markets, futures, and options, looking at each minute’s price changes and order book dynamics. Two key clues gave the game away:

- Order Placement Behaviour: On the flagged days, Jane Street’s orders stood out. During the pump phase, nearly all their buy orders were placed at prices above the last traded price (LTP), effectively pushing the price up intentionally. During the dump phase, their sell orders were consistently below the LTP, designed to pull prices down quickly. This was not normal “best execution” trading; it was deliberate price-impacting execution, which distorted the natural price discovery process.

- Cross-Product Timing: The investigators overlaid Jane Street’s options positions with its stock/futures trades. The timing lined up too neatly: whenever the firm built a large short options position, it was exactly when they were pushing the index up or down in the other market. By tracking these moves across products minute-by-minute, SEBI demonstrated that the index moves were orchestrated to benefit the options bets, which is a strong indication of manipulative intent rather than coincidental arbitrage.

It was a big data triumph. Years ago, a scheme like this might have gone unnoticed or been dismissed as random noise. But with today’s technology, regulators can crunch terabytes of trading data to spot patterns. SEBI even visualized Jane Street’s trading bursts on charts, showing how volumes spiked around the same time windows on multiple expiry days, and how the index moved in those windows. This level of analysis gave SEBI enough prima facie evidence to act swiftly.

Compliance Wake-Up Call: New Age Surveillance

While SEBI’s freeze was headline-grabbing, it wasn’t permanent. Jane Street returned to the market by July 21st under strict conditions. But with the Indian regulator still circling, this saga is far from over, and other regulators worldwide are likely to be watching closely.

Beyond the financial hit, there’s also an ethical and cultural angle: Jane Street was allegedly cautioned by the National Stock Exchange of India in February 2025 about its unusual trading patterns, yet the behaviour continued. Jane Street has since expressed shock and “beyond disappointed” outrage, vehemently denying any wrongdoing. In an internal memo, the firm insisted the trades were “basic index arbitrage”, not a sinister scheme, and vowed to challenge the ban through legal appeals. Regardless of intentions, this case highlights the importance of taking regulator warnings seriously and ensuring traders adjust strategies when concerns are raised, as the reputational and financial damage from being accused of market manipulation can far outweigh the profits from any single strategy.

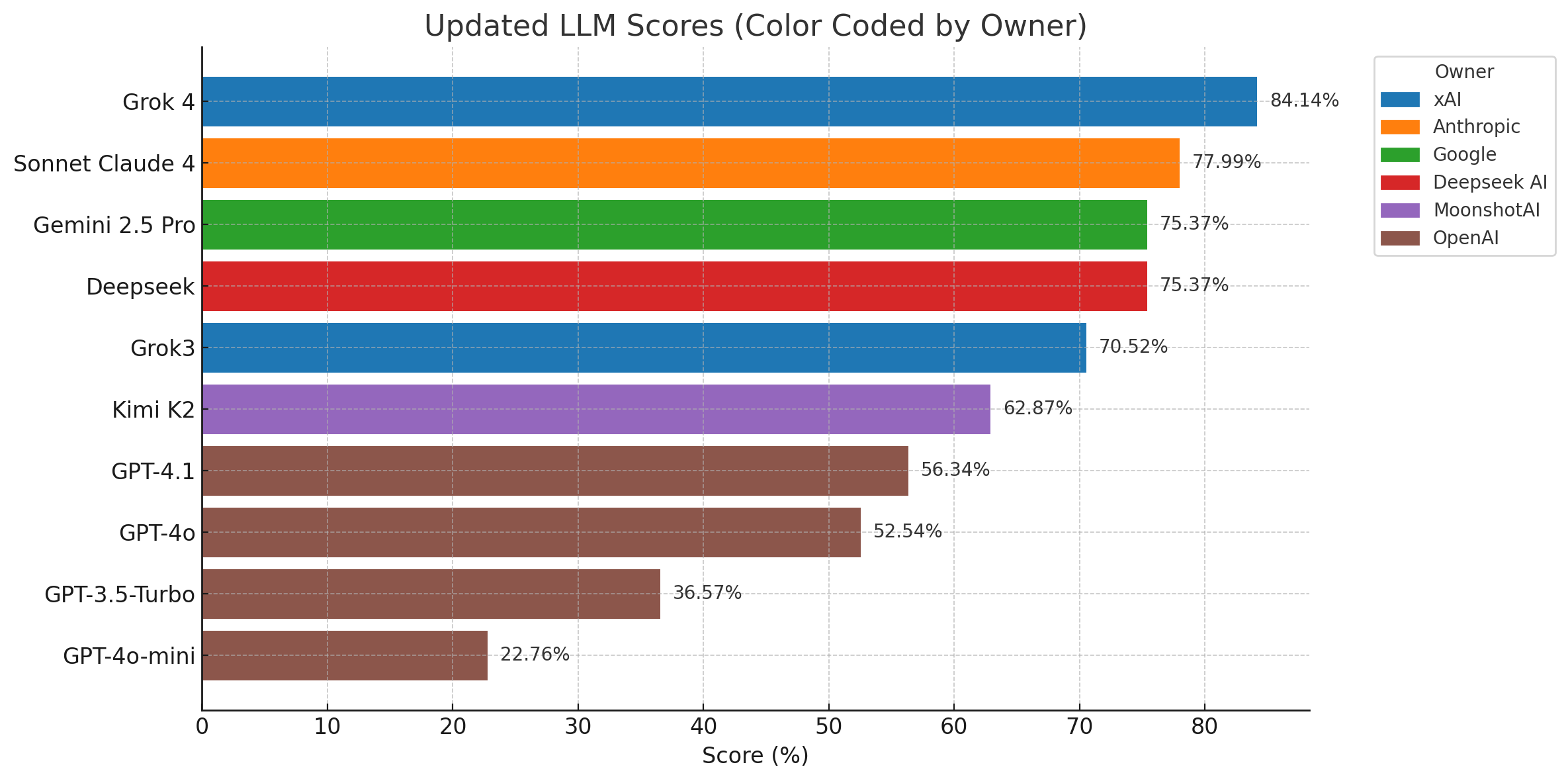

For market surveillance and compliance professionals, the Jane Street saga is a case study in modern oversight. It underscores that regulators are increasingly equipped to detect complex, cross-product manipulation using data analytics. Gone are the days when one could hide a scheme by sheer trading volume or complexity. If you’re moving markets artificially, even just for a few minutes, advanced algorithms will flag it. This is a cautionary tale and a glimpse of the future; as markets are becoming more complex and granular data-driven, surveillance must evolve in tandem. Platforms that can correlate trading activity across assets and markets in real-time, analyse order book dynamics, and apply advanced pattern recognition models are becoming more important than ever before.

Share this: