Jamie Grant

Great news on our joint venture Tradefeedr.com with Alexei Jiltsov and Balraj Bassi. Well done to the team for all the hard work.

LONDON, Sept. 10, 2019 /PRNewswire/ — Founded in 2018 by Balraj Bassi and Alexei Jiltsov, Tradefeedr is a trusted independent intermediary which aggregates, analyses and disseminates trading information between capital market participants to aid data-driven decision making. The co-founders bring a combined 35+ years of experience at buy-side and sell-side financial institutions to the company.

“Today trading information is siloed, counterparty data dialogue is full of friction and there is a lack of reliable benchmarks or rankings. Tradefeedr goal is to consolidate the World’s FX trading information into permission-driven global database that can transform the way in which market participants interact with each other and deliver new insights for all users.” said Balraj Bassi, Co-founder at Tradefeedr.

Liquidity optimisation requires a dialogue based on common data and metrics. Tradefeedr users can share a desired sub-set of their analysis with their counterparties to aid data driven optimisation and collaborate with other users of the platform to build benchmarks. One such initiative is a Global FX Algo book where users can pool algo runs across providers to improve accuracy of performance statistics and create greater transparency for the market.

“Tradefeedr was born of the fact that to achieve better execution both liquidity providers and liquidity consumers need to engage better and what was missing in that interaction is a common data platform. For the first time FX players can use and query a dedicated trade-event repository to share relevant metrics without revealing sensitive details.” said Alexei Jiltsov, Co-founder at Tradefeedr.

Clients can optimise their stack of liquidity providers, fine-tune relationships with individual liquidity providers, compare the quality of liquidity provision across common metrics and design liquidity experiments – such as adding or removing liquidity provision – with measurable outcomes. Common parameters and metrics promote transparency and decrease information asymmetry in the market.

Tradefeedr aims to level the trading analytics playing field by making onboarding seamless and allowing LP’s to submit trading data on behalf of their buy-side clients. It gives each client the power of using tick level infrastructure without associated costs and has a separate, tailored analytical package for GUI, API and Algo flow.

“We see a growing number of market participants looking for independent, third party evaluation of our algos. We welcome this transparency which allows clients to make informed choices in their selection of an algo provider.” – Christian Gressel, Global Head of Electronic Sales Trading, UBS.

”Tradefeedr will enable liquidity providers and clients to analyse and have conversations about data together on a shared platform. For many buy-side firms, this is the first time they’ve had access to such sophisticated, independent analytics and been able to evaluate all their liquidity providers – for risk-transfers and algorithms – in one place. More transparency and more informed clients will result in a fairer market for all.” – Jeremy Smart, Global Head of Distribution, XTX Markets.

‘Goldman Sachs is very supportive of Tradefeedr’s efforts to empower the buy-side with technology to help them deliver on their best execution requirements’ – Conor Daly, EMEA Head of eFX Sales, Goldman Sachs.

“Insight Investment is committed to delivering a best in breed FX offering and initiatives that support the principles of the FX Global Code. Tradefeedr promotes greater transparency and understanding of liquidity provision and market microstructure in FX, improving understanding of execution for all market participants. This is something Insight Investment is keen to actively encourage at every opportunity.” – Nick Robinson, Head of Trading, Insight Investment Management.

Over the coming weeks Tradefeedr will be continuing to onboard more institutions on its way to building an industry wide data utility.

About Tradefeedr:

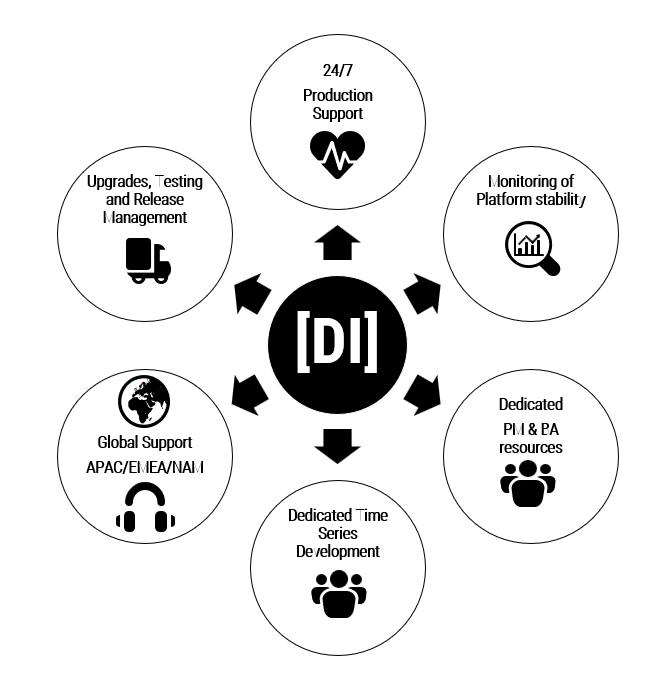

We are a team of ex-traders, data scientists and engineers building a technology stack to aggregate disperse trading information today that will in the years ahead will deliver more advanced data analytics on consolidated data sets, machine learning and collaborative data tools at scale. We believe trading data is most valuable when it is readily accessible, and our clients can use it to answer their own questions.

Tradefeedr is currently used by high volume FX traders, brokers, large asset managers, regional banks and top tier liquidity providers. The platform can be accessed through the web or via a Rest API.

For more information, please visit: https://www.tradefeedr.com/

SOURCE Tradefeedr

Share this: